Đuro Đaković Group business report 1 – 12 2017.

Posted on 31.1.2018.

In the period 1 – 12 2017, Đuro Đaković Group had a total revenue of 547,3 million HRK and total expenditure of 573,5 million HRK.

At the same time, positive EBITDA margin (earnings before interests, taxes, depreciation and amortisation) was reached in the amount of 14,4 million HRK, which makes the EBITDA margin of 2,7%. In the period 1-12 2017, Đuro Đaković Group had operating loss in the amount of 27,1 million HRK, which is negative profit margin of 4,9 %. EBITDA has been improved for 8,5 million HRK, compared to the year before, while the loss generated is 7,6 million HRK smaller.

Reasons for the operating loss are: losses generated in the company Đuro Đaković Industrijska rješenja d.d., extremely high expenditures, as well as losses generated in the company Đuro Đaković Specijalna vozila d.d. in the production of wagons of the type Uacns.

Total revenue of the Đuro Đaković Group is 537,5 million HRK, which is 40,7 million HRK less than in the year 2016. (reduction by 7,1%). Smaller revenues were generated in the Defence Sector (3,9 million HRK less) and Industry and Energetic Sector (166,1 million HRK less). The Transport sector generated revenue growth of 140,4 million HRK due to contracting larger quantities of wagons. Export, as the main source of income for the entire Đuro Đaković Group, also increased by more than 110%. 303,1 million HRK exports were made, which is 158,9 million HRK more than in the year 2016. All market segments achieved revenue growth from export. The share of exports in the total revenues was 56,4%, which shows clear orientation of the Group on export as the primary source of income in the future.

In 2018 the whole Đuro Đaković Group has to face key processes remaining to complete the restructuring process.

The first objective is solving the problem of loan maturity and liquidity, and after that solving the problems of the funding structure in the liability side of the balance sheet, which should lead to the long-term solid financial and operational performance. Regarding the high and extremely unfavourable liability structure (large share of short-term liabilities) the objective of the Group is to change the relations of long-term and short-term liabilities already in the first quarter of the year 2018 and in that way solve the liquidity problem over the medium term.

The second objective is continuation of the restructuring process in the company Đuro Đaković Industrijska rješenja d.d., which should lead to the positive operating result after the implementation of the measures in the year 2018. The measures that are being implemented in this company include optimisation of the number of employees, abolishing certain programmes, labour cost reduction, as well as improvement of the structure of own resources in the liability side of the balance sheet to support reduction in financial costs.

Successful realisation of the first two objectives would create conditions for the implementation of recapitalisation as one of the final objectives of the restructuring process that should lead to the long-term solid and sustainable operational performance.

NEWS

Related articles

7.5.2025.

Proud to have participated at the ASDA 2025 Fair!

Read more

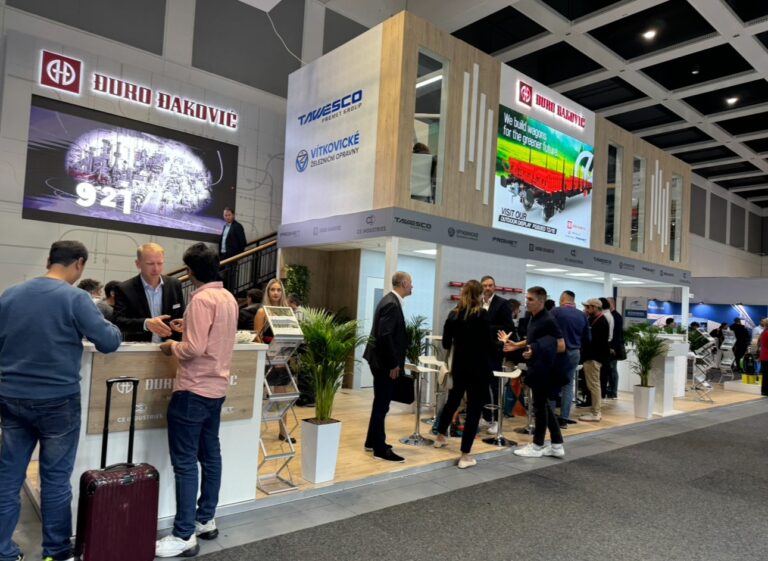

10.10.2024.

We participated at InnoTrans 2024!

Read more

13.5.2024.

Visit of cadets of the Military Engineering Department of the Croatian Military Academy “Dr. Franjo Tuđman”

Read more

6.5.2024.

In Memory with brave workers of Đuro Đaković Special Vehicles

Read more